eBay Accounting: All You Need To Know

Contents

Understandably, as a growing eBay seller, your priority is selling and not getting buried under spreadsheets. But as your business scales, the scales can tip. Your sales are up, yet your financial records are messy, with fees, tax mismatches, and payout gaps throwing off your numbers.

However, when you sell on multiple platforms, the complexity multiplies. Different fee structures, payout schedules, and tax rules add to the chaos. This could mean overpaying taxes, missing deductions, or losing track of cash flow.

Whether you're a reseller or a startup, accurately tracking COGS, inventory, and sales is non-negotiable. This guide simplifies eBay accounting so you can focus on growing your store rather than fixing financial mistakes.

Let’s break it down step-by-step.

What do you need to track as an eBay seller?

To run a successful eBay store, your business should stay compliant and organized. For that, you need to keep track of:

Sales and tax compliance: These include comprehensive sales records, including dates, item descriptions, and prices. Sales tax regulations vary by state, and the IRS needs clear records showing income and expenses to comply with federal tax obligations.

Profitability: Analyzing sales, fees, and costs helps you see your real profits and adjust pricing or strategy as needed. Without this, you could be running a store that looks successful but isn’t profitable.

Bonus read: Profit Vs. Profitability: The Difference and How to Measure Ratios

eBay fees: eBay charges an insertion fee when you create a listing and a final value fee when your item sells. The amount varies depending on the item's price, the format, and the category you choose.

Shipping costs: These vary depending on factors such as package size, destination, and carrier rates. If you use eBay labels, you might get discounted shipping rates, but it also sometimes issues courtesy shipping credits. Hence, you need to keep track of shipping expenses, including carrier fees and packaging costs, to identify potential savings.

COGS(Cost of Goods Sold): These include inventory purchases, packaging costs, and returns to determine profit margins and tax deductions. If a sale gets refunded, eBay may partially refund fees but not always the full amount, so keep track of restocking fees, return shipping costs, and partial fee reimbursements to avoid miscalculating COGS.

Other expenses: Returns, refunds, ad fees, eBay store subscription fees, and dispute fees are small expenses that add up. A detailed summary of these expenses will help you generate accurate financial reports and ensure nothing is overlooked.

Maintaining these records will help optimize pricing strategies, streamline tax filing, and make informed business decisions.

Pro tip: An accounting software eBay integration tool like Webgiity automatically syncs these costs to your accounting software, categorizes them, and helps you generate custom financial reports so your finances are always up-to-date.

But is managing these costs on eBay so straightforward?

What makes eBay accounting and bookkeeping complicated

On the surface, tracking eBay sales and fees might seem simple. But eBay accounting gets messy once you factor in lump-sum payouts, deducted fees, sales tax handling, and mismatched deposit timelines.

eBay payouts are more than just sales

When a buyer makes a purchase, the payment first appears as “Processing” in Seller Hub. But before those funds clear, sellers must still ship the order, covering shipping costs (such as USPS, UPS, or FedEx labels) out of pocket. If the available balance isn’t enough, eBay charges the payment method on file, creating additional tracking headaches.

More importantly, eBay deducts several fees before sending your payout:

- Final value fees (a percentage of the sale)

- Listing fees (for premium or extra listings)

- Shipping fees (if using eBay Labels)

- Ad fees (if you’re using promoted listings)

The solution: Automate recording expenses

A tool like Webgility automatically syncs eBay sales, deducts fees, and categorizes everything into the proper accounts in QuickBooks, NetSuite, or any accounting software. This saves you from guessing where your money went, errors from lump-sum deposits, and inaccurate tax reporting.

Marketplace Facilitator Tax (MFT) & VAT don’t let you off the hook

Although eBay may collect and remit sales tax or VAT on your behalf, these tax amounts fall under Marketplace Facilitator Tax (MFT) rules and never actually belong to you.

However, you’re still responsible for:

- Maintaining detailed transaction records

- Reporting eBay sales in tax filings depending on local regulations

- Staying compliant with varying tax rules across multiple regions

- Managing tax implications for returns and refunds

So if you record them incorrectly, you could overestimate your revenue and miscalculate taxes owed.

The solution: Automate tax reporting

Webgility automates transaction tracking so that there’s accurate tax reporting across platforms. You should consult a tax/VAT professional to keep your business compliant with evolving tax laws.

eBay payout dates don’t always align with bookkeeping periods

Say you make a $500 sale on March 29. The payment appears as "Processing" in eBay’s Seller Hub, but you need to ship the order immediately, using $30 of your own money for a shipping label.

By March 31, the funds are released, but since you’re on a weekly payout schedule, eBay won’t transfer the money until April 5. Then, your bank takes another two days to process the deposit, meaning you finally get access to your earnings on April 7, over a week after the sale.

Meanwhile, eBay would’ve deducted fees and taxes before the payout, so your deposit wouldn’t match the original sale amount. You must manually break down and reconcile sales, fees, and expenses. This gets even messier when selling on multiple platforms.

The solution: Automatically separate payout data based on sales dates

An ecommerce and accounting integration tool like Webgility automatically separates payout data based on when sales occurred, ensuring transactions are recorded in the correct period.

|

Channie’s, a growing eCommerce brand, struggled with time-consuming manual bookkeeping and accounting errors. After integrating Webgility, they automated transaction reconciliation, ensuring accurate sales and expense tracking across multiple sales channels. This method records and consolidates sales accurately. Putting their data on autopilot let the team focus on optimizing their customer experience, resulting in a 250% uptick in order volume and 60+ hours saved. |

Keeping track of different types of eBay fees and transactions

As an eBay seller, you’ll deal with multiple fees—final value fees, listing fees, payment processing fees, and promotional fees for ads. On top of that, eBay transactions go beyond just sales. They include refunds, shipping costs, promotional discounts, and sales tax that eBay collects and remits on your behalf.

Each transaction type needs to be accurately categorized to maintain clean financial records. Misaligned records lead to incorrect profit calculations, tax filing errors, and cash flow issues.

The solution: Automate transaction categorization

Manually keeping track of all types of eBay transaction fee types will leave a huge scope of error. Integrating Webgility will automate transaction categorization so that your accounting software properly records all eBay sales, fees, and taxes. This reduces errors, saves time, and keeps your finances up to date without the headache of manual reconciliation.

What can you do apart from this to keep your eBay accounting smooth and stress-free?

Best accounting practices for eBay sellers

Follow these best practices to stay on top of your business finances.

Summary vs detailed accounting

You can choose between summary accounting and detailed accounting. But which to use when?

Summary accounting helps high-volume sellers prefer a simplified approach. With this, you can record daily, weekly, or monthly sales as a lump sum rather than tracking individual transactions. This saves time, but it lacks the granular insights needed for tax filing or financial reporting.

Detailed accounting records every sale, fee, and expense, providing granular insights into each line item. It helps you create accurate financial reports, track profits, and prepare for an easy tax filing season.

Webgility supports both methods for eBay and multi-channel sellers. It syncs data directly with your eBay accounting software, ensuring every transaction is accounted for, whether summarized or detailed. Moreover, if you’re selling beyond eBay, Webgility consolidates data from multiple platforms and makes omnichannel accounting easy!

Reconciling eBay sales with bank statements

Since eBay deducts fees, taxes, and other charges before transferring payouts, simply recording the deposited amount as "sales" can lead to inaccurate financial records.

To keep books clean:

- Match individual sales to payouts by separating revenue, fees, and expenses

- Track shipping costs paid out-of-pocket versus deducted from eBay funds

- Ensure taxes collected by eBay under Marketplace Facilitator Tax (MFT) laws are accounted for correctly

Webgility automates this process by reconciling eBay transactions with bank deposits in real time. It accurately categorizes fees, expenses, and taxes, ensuring sellers always have a true picture of their earnings. This eliminates manual tracking, reduces errors, and saves valuable time.

Staying tax compliant

When your business hits $20,000 in gross sales and 200+ transactions to meet your state's lower threshold, eBay sends you a 1099-K form. While this reports your total sales, it doesn't account for refunds, fees, or shipping costs. This means your taxable income might look higher than it is. To stay compliant and avoid overpaying, you need accurate bookkeeping that separates sales from expenses.

Webgility automatically categorizes eBay transactions so that you only report what truly accounts as taxable income.

While keeping these best practices in mind, follow this step-by-step guide on eBay accounting.

eBay accounting: Step-by-step guide

Managing eBay accounting requires a structured approach to tracking transactions, categorizing income and expenses, calculating fees and taxes, and generating accurate financial reports.

Step 1: Import your eBay transactions

eBay allows you to import your transaction records by navigating to the "Payments" tab in your Seller Hub, selecting "Reports," and downloading the "Transaction Report" as a CSV file. Connecting your eBay account, you can import this file into your accounting software.

Note: Due to differences in international time zones, the times in your transaction report may not match your records, resulting in discrepancies.

Step 2: Categorize income and expenses

Once you’ve imported the transactions to your eBay accounting spreadsheet, assign each transaction to the right category—sales revenue, sales tax, eBay fees, cost of goods sold (COGS), shipping, or advertising. You can download eBay’s monthly financial statement and sales tax report from Seller Hub to accurately categorize fees and taxes.

Step 3: Calculate eBay fees and taxes

eBay deducts various fees, including final value, listing, and payment processing fees. Since eBay remits sales tax in most states, recording these amounts separately from revenue is crucial. Regularly reconcile payouts with sales data and set aside income tax based on net profit (sales minus fees and expenses) to avoid surprises during tax season.

Step 4: Generate financial reports

eBay’s Seller Hub lets you download reports, but you’ll need to match them with your bank statements to keep things accurate. Keep tabs on sales, fees, and expenses to make tax filing and make smarter business decisions.

Automate all eBay accounting steps with Webgility

Webgility is an advanced eCommerce accounting automation tool that simplifies eBay accounting for online sellers. It syncs all your eBay accounting data in real-time, categorizes it, reconciles bank transactions, and generates accurate financial reports.

|

Task |

Manual bookkeeping |

Webgility automation |

|

Recording eBay sales |

Manually enter each sale into spreadsheets or accounting software, including order details, customer info, and item prices. |

Automatically pulls sales data from eBay and syncs it with your accounting tool in real-time. |

|

Tracking eBay fees |

Manually review eBay and PayPal/Managed payments statements to extract fees and deductions. |

Automatically reconciles fees, including eBay Final Value Fees, listing fees, and payment processing fees. |

|

Processing refunds & returns |

Manually adjust records for refunds and returns, ensuring proper deductions and tax adjustments. |

Auto-detects returns and refunds, updating accounting records instantly. |

|

Managing inventory |

Requires separate tracking in spreadsheets or an inventory management system; high risk of overselling. |

Syncs inventory across eBay, QuickBooks, and other sales channels to prevent overselling. |

|

Bank reconciliation |

Manually matching eBay payouts with bank deposits, ensuring transactions align with order details. |

Auto-reconciles transactions, linking eBay sales and payouts with bank deposits in accounting software. |

|

Sales tax compliance |

Manually calculate tax collected per state, verify eBay’s tax remittance, and prepare reports. |

Auto-tracks sales tax collected by eBay and generates tax reports for easy filing. |

Trusted by 20,000+ businesses, it syncs sales, expenses, and fees from platforms like eBay, Amazon, and Shopify directly into your accounting software, eliminating manual data entry and costly errors.

Here’s what it handles for your business:

- Automated transaction syncing: You can connect eBay with accounting software like QuickBooks or Xero to auto-import sales, fees, and expenses. With automated syncing, all your eBay transactions are imported instantly, saving you hours of data entry each week.

- Multi-channel support: You can reconcile eBay sales alongside other platforms like Amazon, Shopify, and Etsy and get a single, unified view of your finances, making expense tracking way easier.

- Accurate tax handling: Webgility separates sales tax and VAT for correct reporting, so you don’t have to look through individual transactions.

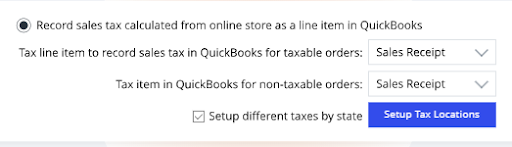

Setup different taxes by state with Webgility

- Real-time profit insights: You can track profitability per order, factoring in fees, shipping, and taxes, and know which products or strategies are working and which aren’t. You can use these insights to make informed decisions fast.

Get order-level profitability report with Webgility

- Payout reconciliation: Webgility automatically matches eBay deposits with actual sales data, so you’ll never be caught off guard by discrepancies.

- Generate custom reports and extract trends: You can generate financial reports for sales trends, tax liabilities, and expenses.

With everything running smoothly in the background, you can focus on growing your business. Why rely on spreadsheets when you can save time, reduce errors, and gain real-time financial clarity whenever needed with Webgility? Get started for free today!

Parag has nearly two decades of experience working with over 10,000 ecommerce sellers to optimize their business processes and grow. His experience working as a Product Lead for Amazon WebStore gives him a unique perspective on the ecommerce market and its remarkable growth. As the CEO of Webgility, Parag has deep insight into the daily operations of ecommerce businesses of all sizes. He believes that most business problems can be solved by looking closely at data and he strives to empower sellers with the data and intelligence they need to succeed. He is a respected voice in the online retail industry and sits on the development councils for both Amazon and Intuit.