Record every order in your accounting system in near real-time

- Post each order into your accounting as it happens

- Track individual customers and items in the sale

- Automatically match existing customers and items

- Create new customers or new items on the fly

- Record every discount and coupon code detail

- Record sales taxes collected per state

- Record order notes

- Record shipping income and details including tracking info

- Track gift card charges, coupons and more

- Use transaction classes for improved reporting

- Granularly map field level details from your sales channel to accounting

Manage returns and refunds with ease

- Create credit memos or refund receipts for every return

- Automatically update inventory of returned items

- Reverse the right account for every return to simplify reconciliation

Break out your orders into separate accounts for easier reconciliation.

- Post orders differently for each marketplace, online store, point of sale location, or third party application

- Specify different settings for order types: B2C, B2B, or POS

- Post orders into different accounts based on the payment processor

- Post orders into different accounts based on order status

- Create sales receipts for paid orders and invoices for unpaid orders

- Use different settings for different types of orders

- Separate rules for posting sales and refunds

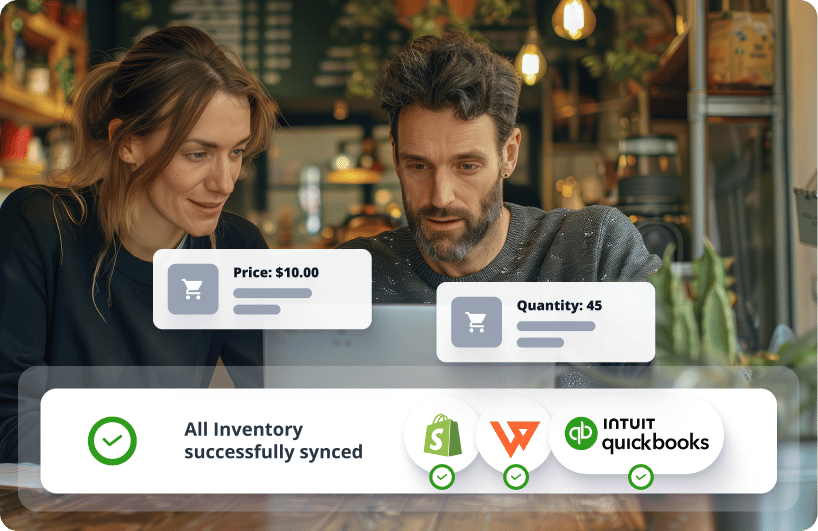

Automatically update inventory with every sale

- Update the inventory level in your accounting as sales are posted

- Works with group items, assemblies and bundled products

- Works with QuickBooks Advanced inventory module

Record all your payment, shipping and marketplace expenses

- Record fees into the expense account of your choice

- Track fees as a group or map every granular fee type

- Bring in fees with every payout

- Connect your payment processor and shipping app to bring in fees for every order

Summarize all your orders per day

- Create a summary sales receipt or invoice for all sales including the items ordered, discounts and taxes collected

- Group all your sales per day instead of tracking every individual sale

- Reduce the number of transactions created in your accounting system while still keeping your financials accurate

- Automatically matches existing items in your accounting

Automatically update inventory at the end of the day

- Update the inventory level of all the items sold in a given day

- Minimize inventory updates throughout the day

Break out your order summary into separate accounts for easier reconciliation

- Post a summary of all your orders for each marketplace, online store or point of sale location separately

- Post the summary into different accounts based on the payment processor

- Post the summary into different accounts based on order status

- Use different settings for different types of orders

- Separate rules for posting sales and refunds

Manage returns and refunds per day

- Create credit memo or refund receipt for all refunds within a given day

- Automatically update inventory of returned items in a given day

- Reverse the right account for every return to simplify reconciliation

Record all your income accurately

- Record sales income from every payout into the right credit account with a simple journal entry

- Record debit journal entries for discounts and coupons

- Record debit journal entries for refunds and shipping expenses

- Record credit journal entries for shipping income

- Record sales taxes collected

- Map to existing bank accounts or automatically create new accounts in your accounting system

Record all your expenses accurately

- Record sales related fees into the right expense account with a simple journal entry

- Record fulfillment related fees into a separate expense account

- Record advertising and other fees in to a separate expense account

- Record all other fees at a granular fee level or group them as "Other expenses"

Record all your transfers and deposits accurately

- Track the deposit into the accurate income account

- Track your account reserves in a separate account

- Track your carried balance for easy reconciliation

Breakout payouts from each marketplace and payment processor

- Record entries for each marketplace and payment processor into separate accounts

- Map to existing accounts or create new ones on the fly

- Track your payouts separate for easy reconciliation and monthly closing

Use clearing accounts to reconcile and close books with ease

- If you record each sale or a daily summary, you can use clearing accounts to track income from sales as they come in

- Once a payout is received, you can match it against your clearing account to fully reconcile your income and expenses

Reconcile and close the books in minutes

Accurately capture all orders and transactions in QuickBooks as they happen, not days or weeks later. Automatically post transactions as sales receipts, and easily deposit funds to dedicated clearing accounts.

Update your books in real-time, on a daily basis or with every payout

Track your income and expenses accurately

Track your bank deposits from each marketplace and payment processor

Quickly and accurately reconcile your net income with your bank deposits in minutes

Get up-to-the-cent accuracy without any manual work

See all your transactions in one place, track history and audit with ease

Track your sales tax liabilities and always be compliant

Track the sales tax collected from all your sales channels

Map the tax collected for every state where you have nexus to the right sales tax account in your accounting for easy filing and reporting

If you're using a third party tool like Avalara for sales tax filing and reporting, you can also map sales tax collected to a single sales tax account so your books are accurate

Have full confidence in your tax compliance and financial reporting across all sales channels

Save money on outsourced ecommerce bookkeeping and accounting

Track all your ecommerce expenses to uncover margin drivers

Marketplace Fees

Webgility brings in all the fees from Amazon Settlement Reports (including FBA), Shopify Payouts, and eBay Invoice Reports into your accounting system. You can group the fees at a high level or track them down to the fee type to get a full picture of your expenses.

Shipping Expenses

Connect Webgility to ShipStation or ShippingEasy to bring in the actual shipping fees for every order and record it into your accounting. Get a true picture of your order-level shipping income vs expense to find opportunities to drive margin.

Payment Fees

Connect Webgility to Shopify Pay, Stripe, Authorize.net or PayPal to bring in the actual payment fees for every order and record it into your accounting. Get a true picture of your order-level payment fees to find opportunities to drive margin.

Simplify the purchase order process with automation

Avoid stockouts and keep customers happy

Webgility helps you set buffers for inventory and generate purchase orders well before you run out of popular items. Purchase order automation capabilities can check the quantity of items in QuickBooks Desktop/Enterprise. Then it can create purchase orders only for items that are out of stock. When you can restock proactively, you keep your customers happy and prevent them from going to competitors.

Generate purchase orders as soon as orders post

Purchase order automation software creates a PO for every order posted to QuickBooks Desktop. For example, if nine orders are posted, there will be nine purchase orders in QuickBooks. Purchase order automation generates orders from templates or based on customizable settings.

Generate purchase orders for dropship-only items

Specify products in QuickBooks Desktop as dropship items. When it's time to generate purchase orders for those items, you can configure Webgility to create purchase orders for dropship items only.

Turbo charge your reporting and get a true picture of your margins

Webgility captures all your ecommerce sales and expenses at a summary or granular level into your accounting so you get generate powerful reports

Get a true picture of your income and expenses by sales channel or payment processor

Analyze your margins, marketplace fees and shipping cost in depth

Ditch the spreadsheets and dive into Webgility's analytics for even more powerful reports including pivot tables

All your channels. All your people. In one place.

Connect all your ecommerce channels and bring all your data into one system

Invite your accountant or bookkeeper for shared access

Add unlimited users without any extra cost

Control which user has access to certain features (Webgility Desktop Plans only)

Your data is secure and always private.

We protect your personal information using industry-recognized security safeguards.

Webgility has gone through rigorous compliance reviews by Intuit, Amazon and other providers to ensure your data is secure and protected.

We conduct regular PEN testing and comply fully with GDPR and CCPA regulations.

Personalized onboarding and unlimited support by ecommerce accounting experts

All Webgility plans include free implementation and training by our resident ecommerce experts so you can get started easily. 5-star rated support without any limits via email, chat or phone.

Lets start automating your accounting today

- 15-day free trial

- Personalized onboarding

- No coding required

FAQs about our accounting features

No, Webgility does not remit sales tax to any particular tax authority. But it can ensure any sales tax you collect routes to the right clearing or undeposited funds in your QuickBooks.

In many cases, you can write off the cost of using Webgility and other necessary work-related business or accounting software subscriptions.

“Unless you have deducted the cost in any earlier year, you can generally deduct the cost of materials and supplies actually consumed and used during the tax year,” according to IRS publication 535.

Generally, any expense you write off should be necessary for running and maintaining the business.

So much!

Webgility can help you stay on top of your ecommerce business with a real-time data sync for orders, expenses, prices, fees, and more.

Webgility can help you gain control of your assets with a real-time inventory sync that updates items accounts no matter where you sell — online or in person.

Webgility can help you grow your bottom line with real-time financial reporting of expenses, cash flow, COGS, and more.